$25.00

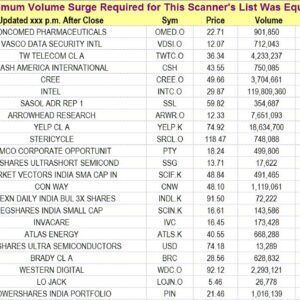

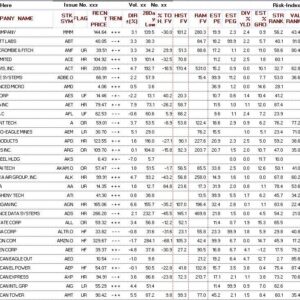

This strategy aims to be invested all the time in the strongest stocks. Each week we provide a list of the strongest 50 stocks tracked by The valuator, arranged in the order of their strength as determined by the strength algorithm of The Valuator. The lists also include the lowest closing prices for the previous 10 and 20 days for possible use in a stop loss strategy. Each week a new list is created and posted for subscribers.

Description

The KISS Strategy

Each week we rank all the stocks in a database of about 500 stocks and provide the subscriber with a list of the top 50 in strength. Every week the stocks in the database are re-ranked and the new list is posted. The investor can use the list in several ways.

He might select the top ten out of the fifty for investment if he thinks they are suitable. Each week, he could replace any that fall out of the top ten or twenty with the stocks that replaced them in the top ten or twenty. Variations on this strategy are possible. For example, he could keep the selected stocks until they fall out of the top 50 and then replace them with those in the top ten that he does not have. Or, he could make these adjustments once a month or once a quarter rather than once a week. Another approach is that he could pick and choose whatever catches his fancy from among the top twenty, replacing those that fall out of the top ranks. An alternative sell strategy would be to sell those stocks that fall below their lowest closing price of the previous 10 or 20 days, because such stocks probably would no longer be in an uptrend.

These strategies depend on a strength algorithm that finds more persistent strength than what is found by the Relative Strength Index (RSI). We have such an algorithm. It is the same algorithm used in The Valuator, The “Strongest Stocks” subscription, and the “Strongest ETFs” subscriptions. The other part of the strategy requires a universe of limited size but made up of respectable stocks (not penny stocks or new issues). Why a limited size? Because using this particular strategy on a list of several thousand stocks would probably result in too many stocks being replaced every week. There would be too many candidates vying for each position.

The Valuator tracks about 500 stocks (give or take a few). Each week we provide a list of the strongest 50 stocks tracked by The valuator, arranged in the order of their strength as determined by the strength algorithm of The Valuator. The lists also include the lowest closing prices for the previous 10 and 20 days for possible use in a stop loss strategy. Each week a new list is created and posted for subscribers. Get more details about this strategy

The lists are not recommendations to buy or sell. They are lists of stocks having the highest ranking scores.