$25.00

Click on the image to the left

to get a better view.

See description lower on this page.

Description

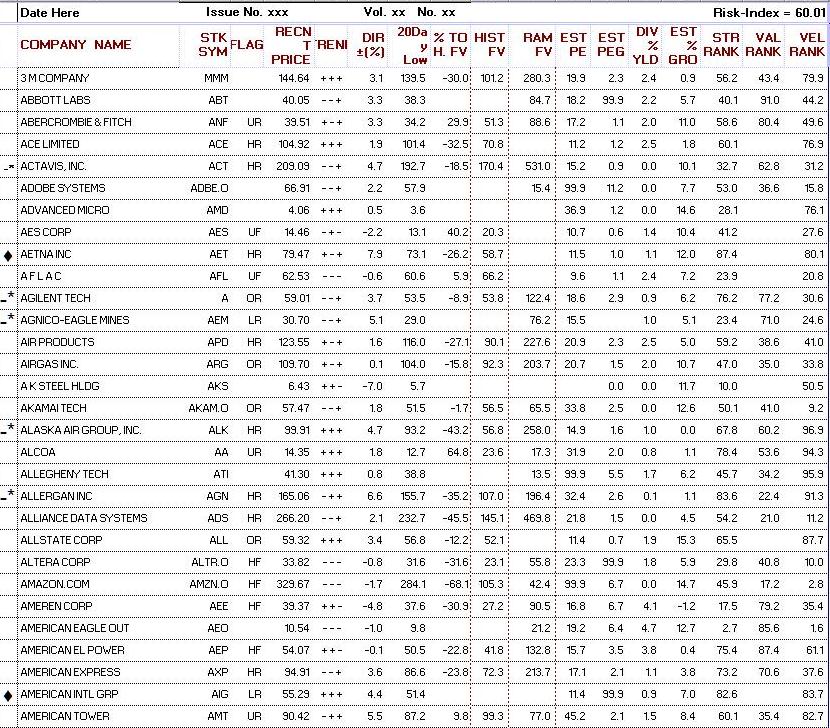

Watch-list Candidates & Target Prices

Fundamental & Technical Measurements.

The report subscribers get now has an additional column in which we identify the industry.

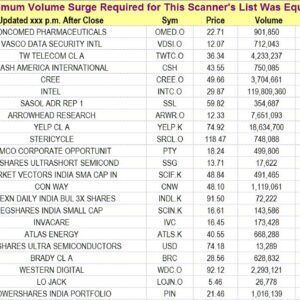

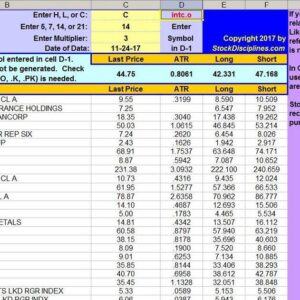

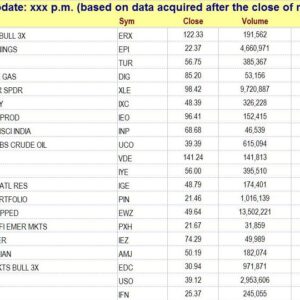

The Valuator is published weekly, and it provides numerous measurements of stock behavior and value. These include the “►” and “♦” alerts, the Eight “Flag” indicators that show where a stock is in its price cycle (all stocks cycle), the “Trends” indicator that maps the direction of 3 consecutive 20-day trends, the “Direction ± (%)” indicator showing the direction and change of the most recent 20-day period, the “20-Day Low,” the distance in % before a stock reaches its price Center of Gravity (the price about which the price oscillates (like a moth circling a light bulb) and the price most likely to be revisited by the stock, The C.G. or “Center of Gravity” or price of highest probability , PE, Dividend Yield, Earnings Yield, Strength Rank, Value Rank (based on a composite of valuation measurements), and Velocity Rank. The Valuator is spreadsheet sortable. However, we do presort the data in several categories, listing the top 38 in each category (for those who do not want to sort a spreadsheet). The Valuator gives follow-up information every week.

“Fair Value” vs. “Center of Gravity”

People buy high and sell low because at any given time they have no rationale for judging where it is relative to its “fair value.” The price of each stock swings up and down between being “overvalued” and “undervalued” relative to ANY measure of the underlying value (the “fair value”) of the stock. The market’s concept of “fair value” for a stock is not constant. “Fair value” is what the market thinks it is. Like it or not, “fair value” is tied to market sentiment. People use various measurements and ratios to express “fair value” and those metrics give a sense that fair value is something that can be quantified. However, “fair value” always has a context that in some way shapes the meaning of “fair value.”

In The Valuator, there is a column that shows specifically how far a stock must rise (in percent) to reach our estimate of its “Center of Gravity.” The “Flag” indicator is another way this issue is addressed.

FLAG (Column D): This column shows where a stock is as it oscillates above and below its “Center of Gravity.” “Center of Gravity is what we use for short-term to intermediate-term “Fair Value.” This is the price most likely to be revisited within the next few months. The traditional “Fair Value” may take years to reach and may turn out to be inaccurate after a long wait. Our “C.G.” is based on probability and statistics, not on analyst’s estimates of earnings for the coming year nor on last year’s earnings data. Rather, it is based on the stock’s behavior over the most recent two years. Our Flag alert indicates where a stock is in its cycle. Imagine a stock swinging up and down between extremes and that across the middle of these swings is a horizontal line marking its “fair value.” In the image below, substitute the words “Center of Gravity” for “Historical Fair Value.”

This column defines eight positions in a stock’s cycle: “HF” = High and falling (it is at or above its expected high and it is on its way down), “OF” = Overpriced and falling (it is above the “Center of Gravity” but below its expected high and it is declining), “UF” = Under-priced and falling (it is below its “Center of Gravity” and falling, “LF” = Low and falling, “LR” = Low (below its expected low price) and rising, “UR” = Under-priced (between expected low and its “Center of Gravity”) and rising, “OR” = Overpriced (but below its expected high) and rising, and “HR” = High and rising.

We know of no other market letter that provides as much information (with regular follow-up) at anywhere near the low price of The Valuator. However, there are many market letters of about half the size (with a lot less information) that are available at about twice the price.

NOTE:

Analysts tend to base their reports on the past year (outdated) or make estimates for the next year (they are notoriously wrong). For over 30 years, our valuation models were based on financial data for the last 6 months combined with analyst estimates for the next 6 months (they are more accurate when looking ahead only 6 months). However, we have decided to make a significant change. We wanted more accurate, more timely, and more reliable data and price targets.

For more information on why we changed from “Fair Value” valuations based on earnings and other fundamental information to “valuations” based on statistics and the mathematics of probability click on Center of Gravity

You must be able to open an Excel spreadsheet on your computer to be able to download the spreadsheets of The Valuator.

See List of Stocks Tracked by The Valuator

This description is barely an introduction. It is only a brief excerpt from the much more complete description and explanation of features along with illustrations that can be viewed at The Valuator

Before ordering, see our policies regarding automatic renewals, cancellations, and refunds

Return to the “Products & Prices” page