$75.00

Click on the image to the left

to get a better view.

See description lower on this page.

Description

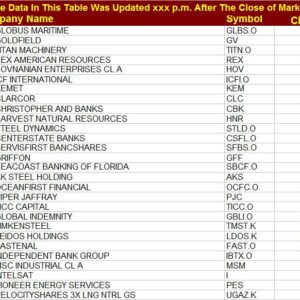

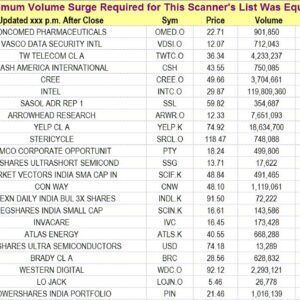

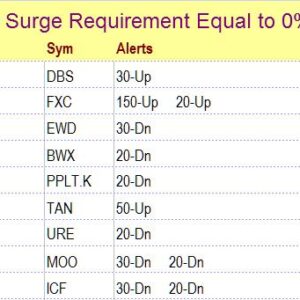

Some of our algorithms focus on persistent strength (we have one for individual stocks and one for ETFs), some detect moving average crossovers (one for stocks and another for ETFs), one finds Bollinger band squeezes with a subsequent band penetration, and so on. Our scans “look” for a wide range of conditions. For example, The R.C.Allen triple crossover system, the 5x10x20 crossover system, the Donchian dual moving average crossover system, gap alerts, trading channel breakouts, and others are included (the R.C. Allen triple moving average crossover system is now part of Stock-Scanner). Many of these alerts also include volume surge information.

The Valu-Pak consists of the following listed subscription services. The Valu-Pak price cannot be applied to anything less than the full bundle consisting of all scanner lists. If a subscriber wants only one or two subscriptions rather than all of them, it will be necessary to pay for them at their normal individual rates. A reduction in the fee for the Valu-Pak cannot be obtained by dropping a few components of the bundle. A cancellation of any portion of the service can only be accomplished by canceling the entire service.

Note: Stops is not included in Valu-Pak.

The Valu-Pak Includes the Following Reports.

(M) means it is issued monthly, (W) means it is issued weekly

StockAlerts (W)

ETF Alerts (W)

Strongest ETFs (W)

Strongest Stocks (W)

Stock-Scanner (W)

Breakouts (W)

R.C. Allen Alerts (W)

HotStocks (W)

Kiss (W)

The Valuator (online) (M)

If you are ordering Valu-Pak, please do not also order any of the above subscriptions separately, because they are included in the Valu-Pak.

Please be aware that if we determine a particular list or service provided through the Valu-Pak is not very popular, it will be discontinued. For example, at one time we provided a daily list of all stocks in the S&P500 with information on each stock. Each report listed all 500 stocks along with alerts for each R.C. Allen and each Donchian “buy” or “sell” signal. It was included in Valu-Pak, but very few people subscribed to it as a stand-alone subscription. We do not have the resources to spend time providing a service that few people want. It is better to cancel it and devote our time and energy on a service that people value. When we discontinued it, we also deleted it from the Valu-Pak. When we develop a new service, it may be added to Valu-Pak immediately. However, its continuance in the Valu-Pak will depend on how popular it is as a stand-alone subscription..

There are thousands of stocks in the market. It is impossible for an individual to be aware of what is happening with all of them. Therefore, we use computer-driven scanners to find stocks that satisfy certain preliminary conditions. Our algorithms cannot see charts as a human can. On reviewing the lists we generate for our own trading purposes, we may sometimes eliminate 90% of the stocks on a given list (or even the entire list) because of nearby resistance or some other consideration that could not be “seen” by the search algorithm. For example, a Bollinger band squeeze followed by an upper band penetration (or any other “setup” configuration) may not be attractive to our traders because there is overhead resistance just above the current price. The algorithm will not see that resistance. It will, however, detect that a band penetration has occurred after a band squeeze or whatever setup pattern the algorithm is designed to detect. In using our lists, it will be up to the subscriber to filter the results of our searches. In other words, our lists are not buy or sell recommendations. They are simply alerts indicating that our algorithm “thinks” certain preliminary conditions have been met. Our algorithms are not perfect, but they do make it much easier to find stocks worth putting on a “watch list.”

Before ordering, see our policies regarding automatic renewals,

cancellations, and refunds.

Also, before ordering, read this important message.

The “Valu-Pak” is a subscription “bundle” that gives access to all of our scanner

lists and to the online version of The Valuator.